Do You Need an SR-22?

An SR-22 is a certificate of financial responsibility that may be ordered by a court or required by the state after certain driving offenses like DUIs or driving without insurance. This certificate proves you have the minimum required liability insurance on your vehicle.

If a judge orders you to get an SR-22 you’ll be told during your court appearance, usually as part of your sentencing. If it’s required by the state you’ll get a formal notice from your state’s DMV with the specific requirements and deadlines to file.

At Motive Insurance, an affiliate of Geico, we know the SR-22 filing process can be overwhelming. We’ll walk you through it all, so you can meet the requirements to keep your driving privileges and stay in compliance.

Our team is here to help you file an SR-22 quickly, answer any questions you have and find the right coverage for you.

Understanding the Need for an SR-22

Not everyone needs an SR-22. It’s usually required for those who were found driving without insurance or a valid license. Other situations that may require an SR-22:

- DUI or DWI convictions

- Driving with insufficient insurance

- Multiple at-fault accidents or traffic violations

- Multiple offenses within a short period (three speeding tickets in six months)

- Failure to pay court-ordered child support

- Hardship license, which is limited for essential travel, usually to work, if your license is suspended or revoked

Differences Between SR-22 and FR-44

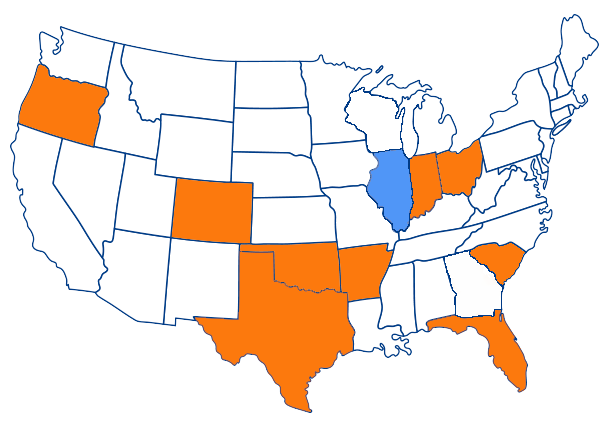

The FR-44 is a form similar to an SR-22 but is specifically used in the states of Florida and Virginia, typically in cases following a DUI or DWI conviction. This document serves as proof of financial responsibility, required by the state to reinstate a driver’s license after such offenses.

The primary difference between an FR-44 and an SR-22 lies in the liability limits mandated; the FR-44 requires significantly higher liability limits, often double the minimum requirement set by the state. This ensures that drivers involved in serious offenses carry adequate insurance coverage for any future incidents.

Costs Associated with SR-22

The FR-44 is a form similar to an SR-22 but is used in Florida and Virginia after a DUI or DWI conviction. This document is proof of financial responsibility required by the state to reinstate a driver’s license after such offenses.

The main difference between an FR-44 and an SR-22 is the liability limits; the FR-44 requires much higher liability limits, often double the state minimum. This means drivers who commit serious offenses have to have more insurance coverage for future incidents.

Impact of SR-22 on Insurance Premiums

Being required to have an SR-22 means you’re considered a high-risk driver and will likely pay higher insurance rates that can hit your wallet hard. This isn’t just about higher rates but also how insurers view you as a customer.

The rate increase isn’t uniform and depends on many factors: your location, the type of vehicle you drive, your driving history and overall insurance record. Each of these factors plays a part in how much more you’ll pay. Knowing these variables will help you better manage the cost of this classification.

Now that you know what affects your rates, you can start to manage the cost over time by seeking discounts, improving your driving record or shopping around for better insurance provider deals. Being proactive and informed will make a big difference in how you handle the SR-22 requirement.

Duration and Removal of an SR-22

You’ll usually need to have an SR-22 for about three years but this can vary by state. Make sure to check with your state’s Department of Motor Vehicles (DMV) to confirm the exact duration.

To remove the SR-22 from your policy you’ll need to contact your insurance company directly as it won’t automatically be removed once it’s no longer required. If you do remove the SR-22 your rates may go down especially if they were increased because of the SR-22 filing.

Remember if your policy lapses or is canceled while you still need an SR-22 your insurance company will notify the DMV and your license will likely be suspended. So it’s important to keep your policy in force without interruption to avoid more hassle.

Contact us for more info.

For more detailed information or assistance with SR-22 filings, feel free to reach out to the insurance experts at Motive Insurance. They can provide guidance tailored to your specific situation and help navigate the complexities of maintaining and removing an SR-22 from your insurance policy.

FAQs

Do you need an SR-22 after an at fault accident?

If you’re involved in an at fault accident, you may need an SR-22 if required by a state or court order. Your insurance company files the SR-22 to confirm that you have the required liability insurance as part of your car insurance policy.

Why do high risk drivers need an SR-22?

High risk drivers may need an SR-22 to prove they have the necessary liability coverage. This is often required after serious traffic violations or accidents. Your car insurance company will provide the SR-22 form to your state’s department of motor vehicles.

How do I get an SR-22 from my car insurance company?

To get an SR-22, contact your insurance agent or car insurance company. They will file the SR-22 with the state to show that you have the required auto insurance, including bodily injury liability and other necessary coverages.

Will an SR-22 affect my car insurance policy?

Yes, needing an SR-22 usually increases your car insurance policy costs. Since high risk drivers are required to have an SR-22, car insurance companies may charge higher premiums for your auto insurance.