Motorcycle Insurance Coverage

At Motive Insurance, a local agency proudly affiliated with Progressive Insurance, we offer coverage solutions for every motorcyclist, no matter what you ride—ATV, UTV, sport bike, cruiser, dirt bike.

Riding a motorcycle has risks no matter where you ride—highways, city streets or off-road. That’s why having good insurance coverage is key for every rider.

Our team knows the challenges motorcyclists face and will make sure you have the right coverage for you and your lifestyle. Trust Motive Insurance to keep you covered so you can ride free and enjoy the thrill with peace of mind.

Tailored Motorcycle Insurance Plans

Motorcycle insurance costs vary greatly based on your riding habits, type of motorcycle, where you ride and your riding history.

These are the factors that will determine the right coverage for you. At Motive Insurance, our team goes the extra mile to create insurance plans that are comprehensive and affordable.

We customize these plans for every motorcyclist so you can ride worry free. Whether you’re an experienced rider or just starting out, we’ve got insurance solutions for you and your lifestyle.

Requirements for Motorcycle Insurance

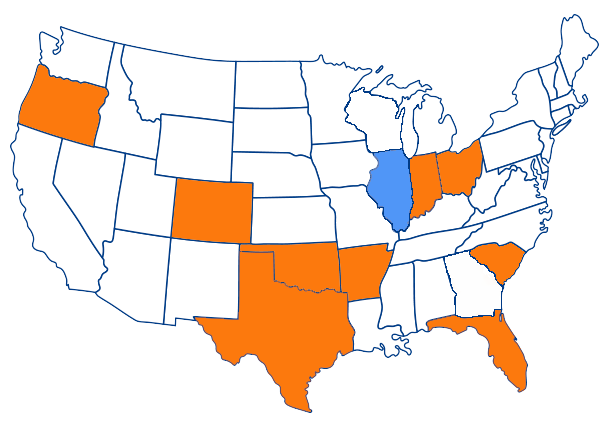

In the US, almost all states require some form of motorcycle insurance for riders. Typically the minimum is liability coverage which helps pay for damages if you’re at fault in an accident.

But if you’re financing your motorcycle, your lender may also require you to have comprehensive and collision coverage to protect their investment. These additional coverages will cover repair or replacement costs in more situations such as theft or non-collision damage.

Even if you live in a state where motorcycle insurance is not required, it’s highly recommended you have one. Having motorcycle insurance will give you peace of mind and financial protection against damages and liability so you and your bike are protected against the unexpected.

Coverage Options for Motorcyclists

Our motorcycle insurance policies are designed with comprehensive coverage in mind so you’re protected against a wide range of on and off road incidents. Knowing how important it is to protect your ride, we break down the typical coverages in our plans:

- Liability Coverage: This is required in most states and will protect you by covering damages to property and injuries to others if you’re at fault in an accident. It’s a must have for any responsible rider’s insurance.

- Comprehensive Coverage: Beyond collisions, this coverage will cover non-collision related incidents such as theft, vandalism and natural disasters. If you’re financing your motorcycle, comprehensive coverage is often required and will give you peace of mind that your investment is protected from many risks.

- Collision Coverage: Whether you hit another vehicle or an object, collision coverage will take care of the damage to your motorcycle no matter who’s at fault. It’s an essential part of a complete insurance policy.

- Uninsured/Underinsured Motorist Coverage: Not every driver on the road is insured. This coverage will protect you from damages caused by drivers who have no insurance or insufficient insurance to cover an accident.

- Medical Payments Coverage: Accidents can result in unexpected medical bills. This coverage will pay for medical bills for you and your passengers, no matter who’s at fault, to help alleviate the financial burden during recovery.

With these options, our motorcycle insurance policies will give you the coverage you need to ride worry free.

Enhanced Coverage Options

Motive Insurance, in partnership with Progressive, offers these additional coverages to give you even more security and support:

- Total Loss Coverage: If your new motorcycle is totaled, we’ll pay you the full retail price for a brand new motorcycle minus your deductible. So you won’t be left out of pocket and can get back on the road quickly.

- Roadside Assistance and Trip Interruption: This coverage provides towing services and support if your trip is interrupted due to motorcycle breakdowns. Plus it includes additional benefits such as coverage for food, transport and lodging expenses so you’re taken care of during the unexpected.

- Carried Contents Coverage: Protects personal items you carry on your motorcycle such as electronic devices and gear against covered losses. So your valuable belongings are protected wherever you ride.

- Disappearing Deductibles: For every term you’re claim free, we’ll reduce your deductible by 25% and it can drop to zero. This rewards system encourages safe riding and gives you financial relief over time.

- Enhanced Injury Protection: Pays a weekly stipend if you’re injured and can’t work and a lump sum to your beneficiaries in the event of a fatal accident. This coverage gives you financial security during tough times.

- Full Value for Replacement Parts: Guarantees replacement parts are fully covered without depreciation so your motorcycle is restored to its best condition without extra cost.

With Motive Insurance we want to give every motorcyclist a complete insurance package that gives you peace of mind and support on the road. Our experts will help you through all the options to find the right coverage for your motorcycle adventures. Ride worry free with us.

FAQs

What motorcycle insurance covers theft and other damages?

A motorcycle insurance cover theft protects your bike against loss or damage due to theft. Additionally, a comprehensive motorcycle policy includes motorcycle coverage for accidents, vandalism, and natural disasters. This ensures that your motorcycle safety and financial security are maintained in various situations.

How can I obtain an affordable motorcycle insurance quote?

To obtain an affordable motorcycle insurance quote, compare rates from multiple auto and motorcycle insurance companies. Look for motorcycle insurance discounts such as safe rider discounts or bundling policies. Utilizing resources like the Motorcycle Safety Foundation can also help reduce motorcycle insurance costs and save money on your motorcycle insurance policy.

What factors influence motorcycle insurance costs and how can I save money?

Motorcycle insurance cost is influenced by factors like your riding history, type of motorcycle, and coverage levels. Choosing a cheap motorcycle insurance option may reduce coverage, so it’s important to balance affordability with adequate protection. To save money, consider motorcycle insurance discounts, maintain a clean riding record, and select a motorcycle policy that fits your budget while ensuring comprehensive coverage.

Can I bundle auto and motorcycle insurance for better coverage and savings?

Yes, bundling auto and motorcycle insurance can provide better coverage and significant savings. Many insurance companies offer discounts when you purchase both auto and motorcycle insurance together. This not only makes your insurance more affordable but also simplifies managing your policies. Additionally, bundling can enhance your overall insurance coverage, ensuring both your car and motorcycle are well-protected.