Owning a vehicle comes with numerous responsibilities, and one of the most important is ensuring you have adequate auto insurance coverage. Whether you’re a new driver or have been on the road for years, understanding the intricacies of auto insurance can help you make informed decisions and protect yourself financially. In this article, we’ll break down the essentials of auto insurance, including coverage types, factors affecting premiums, and tips for choosing the right policy.

Types of Auto Insurance Coverage

- Liability Insurance

- Bodily Injury Liability

- Covers medical expenses, lost wages, and legal fees if you’re at fault in an accident that injures others.

- Property Damage Liability

- Pays for repairs or replacement of another person’s property damaged in an accident you caused.

- Bodily Injury Liability

- Collision Insurance

- Covers the cost of repairing or replacing your vehicle after a collision, regardless of who is at fault.

- Comprehensive Insurance

- Protects against non-collision-related damages such as theft, vandalism, natural disasters, and hitting an animal.

- Personal Injury Protection (PIP)

- Covers medical expenses and, in some cases, lost wages and other related costs for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage

- Provides protection if you’re involved in an accident with a driver who has insufficient or no insurance.

Factors That Affect Your Auto Insurance Premium

- Driving Record

- A clean driving history with no accidents or traffic violations typically results in lower premiums.

- Age and Gender

- Younger drivers, especially males, often face higher premiums due to higher risk profiles.

- Vehicle Type

- The make, model, and year of your vehicle can influence your premium. High-performance and luxury cars usually cost more to insure.

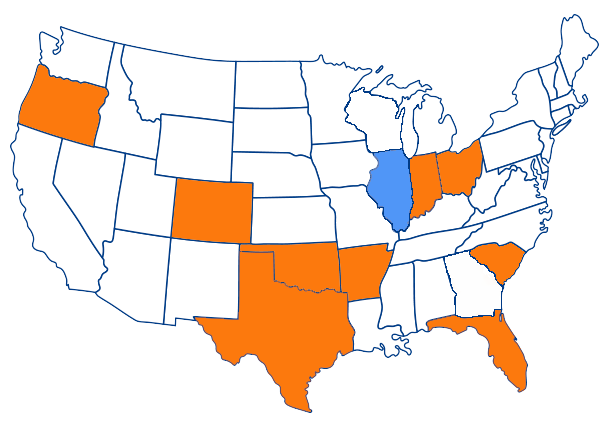

- Location

- Urban areas with higher traffic density and crime rates may lead to higher insurance costs compared to rural areas.

- Coverage Levels and Deductibles

- Higher coverage limits and lower deductibles increase your premium, while opting for higher deductibles can reduce your costs.

- Credit Score

- In many states, insurers use credit scores to help determine premiums. A better credit score can lead to lower rates.

Tips for Choosing the Right Auto Insurance Policy

- Assess Your Needs

- Consider factors such as your driving habits, the value of your vehicle, and your financial situation to determine the coverage levels you need.

- Compare Quotes

- Obtain quotes from multiple insurance providers to find the best rates and coverage options that suit your needs.

- Bundle Policies

- Many insurers offer discounts if you purchase multiple policies, such as auto and home insurance, from them.

- Maintain a Good Driving Record

- Safe driving not only keeps you and others safe but can also help lower your insurance premiums over time.

- Take Advantage of Discounts

- Inquire about available discounts, such as those for safe drivers, students, military personnel, and vehicles with safety features.

- Review and Update Your Policy Regularly

- Life changes like moving, getting married, or purchasing a new vehicle can impact your insurance needs. Regularly reviewing your policy ensures you have adequate coverage.

Conclusion

Understanding auto insurance is crucial for every driver. By familiarizing yourself with the different types of coverage, the factors that affect premiums, and strategies for choosing the right policy, you can ensure that you’re adequately protected on the road without overpaying. Take the time to evaluate your needs and explore your options to find an auto insurance policy that offers the best balance of coverage and affordability.