Homeowners Insurance

In today’s crazy world, fires, theft and natural disasters are very real threats to our homes which are often the biggest investment we’ll ever make.

These events can disrupt our lives in ways we can’t even imagine, leaving us vulnerable and stressed. At Motive Insurance we understand the importance of protecting your home and we’re here to help you protect your investment.

Our homeowners insurance will give you the protection you need so you can get your peace of mind back and focus on what really matters in life. With us, you’ll know you have a partner to back you up through life’s unexpected twists and turns.

Understanding Homeowners Insurance Costs

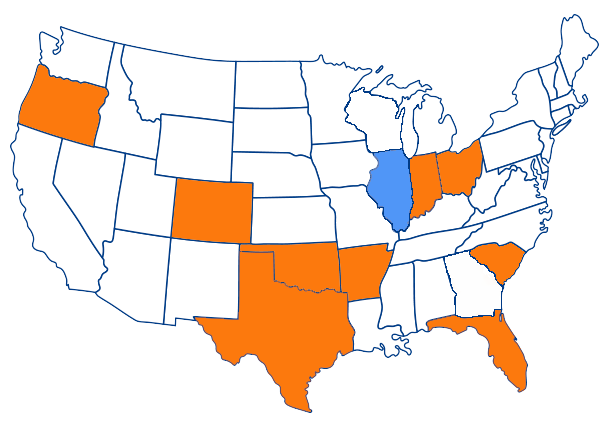

Homeowners insurance costs can vary greatly depending on many factors including the value of your home, your location and your claim history. These variables can have a big impact on your premiums. Understanding these factors is key when looking for insurance that suits you and your budget.

At Motive Insurance we know your most valuable asset is your home. Backed by the expertise of Geico Insurance our team will develop a solution for you.

We’ll make sure your home is well covered, so you can have peace of mind and get coverage at a fair price. Our commitment is to give you full and customised protection that suits your situation so you get the best possible insurance.

Coverage Details of Homeowners Insurance

Our homeowners insurance policies, backed by Geico, are carefully designed to give you broad coverage for your home and property against many risks. We know how important it is to have peace of mind when it comes to your home so that’s why our policies are full.

Here’s what our policies cover:

- Structural Protection: Covers damage to your home from events like fire, severe weather, theft, vandalism and many other risks. So the heart of your home is protected from the unexpected.

- Coverage for Detached Structures: Covers structures on your property like sheds, garages and fences. So not just your home but the additional structures on your property are well covered.

- Personal Possessions Coverage: Covers loss or damage to your personal belongings. This includes electronics, furniture and even groceries so you’re covered for the things that matter in your home.

- Liability Coverage: Protects you if someone gets injured or their property gets damaged and you’re found legally liable. This covers incidents both on and off your property so you’re fully covered.

- Additional Living Expenses: If your home is severely damaged this coverage helps with the costs of temporary housing and living expenses while repairs are underway so the transition is eased during tough times.

Our policies give you a broad safety net so your home and lifestyle is well covered. With Geico behind us our coverage lets you focus on what really matters – living life with confidence and security.

Enhanced Coverage Options

To further customize your protection Motive Insurance offers several additional coverages to suit many needs:

- Replacement Cost Coverage: This option covers the full cost of replacing your belongings without depreciation. Whether it’s your electronics, furniture or personal items you’ll be compensated based on the current replacement cost so you can replace your possessions fully.

- Umbrella Liability Insurance: This provides extra liability coverage beyond your standard policy. It’s useful for unexpected events that could lead to big legal claims so you have peace of mind if you’re faced with big financial liability.

- Flood Insurance: Traditional homeowners policies don’t cover damage from flooding. Our flood insurance fills the gap and covers your home and belongings from water damage from unexpected natural disasters like heavy rain or overflowing rivers.

- Endorsements for Earthquakes and Windstorms: These coverages are for less common but potentially catastrophic natural disasters. Whether you live in an earthquake prone area or severe storm zone these endorsements will ensure you’re financially protected against the unique risks of these events.

- Pet Liability Insurance: For pet owners this coverage is essential. It covers incidents where pets may accidentally harm others or damage property so you’re protected from potential legal and repair costs.

Motive Insurance builds a safety net around your home so you’re ready for whatever life throws at you. Our team will help you build a protection plan that’s right for you.

FAQs

What does homeowners insurance cover and how does it differ from home insurance?

Homeowners insurance cover typically includes protection for your home’s structure, personal belongings, liability, and additional living expenses. While home insurance is a broad term that can refer to various types of property insurance, homeowners insurance coverage specifically targets homeowners, offering tailored protection through a homeowners insurance policy.

How can you get the best homeowners insurance quotes from an insurance company?

To obtain the best homeowners insurance quotes, it’s important to shop around and compare rates from multiple insurance companies. Make sure to assess each insurance policy’s details and homeowners coverage to ensure you are getting comprehensive protection for your needs. This comparison can also help in identifying potential homeowners insurance discounts.

Does homeowners insurance cover mold and what factors affect homeowners insurance cost?

Homeowners insurance cover mold under specific conditions, particularly if it results from a covered peril, like water damage from a burst pipe. However, standard policies often exclude mold caused by maintenance issues. Homeowners insurance cost can be influenced by factors such as the property’s location, age, and construction type, as well as the homeowner’s claims history.

Why do mortgage lender require homeowners insurance, and what should a homeowners insurance faq include?

Mortgage lenders require homeowners insurance to protect their financial interest in the property should it be damaged or destroyed. A homeowners insurance faq should include details about insurance coverage, the claims process, homeowners policy options, and tips on obtaining discounts. This information can help homeowners better understand their insurance needs and options.