General Liability Insurance

General liability is business protection, covering slip and fall accidents, property damage and bodily injury claims. Whether you have a small shop or a big business, you need the right coverage to protect against the unexpected liabilities.

This gives you financial protection and peace of mind so you can focus on growth without worrying about legal battles or financial setbacks. Plus, clients and partners prefer to work with prepared and responsible businesses that have proper insurance coverage.

What Is General Liability Insurance?

General liability is a commercial policy that protects businesses from third party claims for property damage, bodily injury and advertising mistakes. It covers legal costs such as attorney fees, settlements and judgments.

The policy pays out when a covered claim is made against the insured business arising from its operations, premises or products/services. For example, if someone gets injured in your store or office, general liability will pay for their medical expenses and bills and any related legal expenses.

What Does General Liability Insurance Cover?

General liability provides essential coverage, giving businesses peace of mind against many unexpected events. Here’s a breakdown of what it covers:

- Bodily Injury: This covers medical bills and legal costs if someone gets injured on your premises or due to your business operations. This can include slip and fall in your store or an injury caused by your product.

- Property Damage: Protects against claims for damage to another person’s property caused by your business activities. For example, if your construction project damages a neighbor’s property, this will help with repair costs.

- Personal and Advertising Injury: This covers claims related to libel, slander, false advertising or copyright infringement. If a competitor claims your ad misrepresents their product or damaged their reputation, this commercial general liability insurance will cover the legal battles.

- Legal Defense Costs: Covers the cost of legal representation and other expenses to defend against covered claims. Even if the claim is unfounded, legal defense can be expensive and this coverage ensures you’re financially prepared to handl

General liability is business protection, so unexpected events don’t stop your business or cost you big time.

Why General Liability Insurance is Crucial

Every business, big or small, faces risks from many sources. Physical accidents like slip and fall, property damage from storms or vandalism and legal disputes over negligence or breach of contract. General liability is the safety net that covers the costs of

This lets you manage risks, focus on your business and growth without worrying about legal battles and financial losses. With this coverage you can face entrepreneurial challenges knowing you’re prepared for the unexpected.

Benefits of General Liability Insurance

Here are the benefits:

- Financial Protection: Provides a solid shield for your business against big financial losses that may arise from lawsuits and claims, including legal fees, settlements or judgments that can be detrimental to your financial health.

- Peace of Mind: Gives you reassurance and confidence that you’re prepared for unexpected events and legal challenges. This security lets you focus on business growth and operations without worrying about potential legal threats.

- Business Continuity: Ensures your business can keep running smoothly even when faced with legal claims. By minimizing disruptions you maintain customer trust and keep your business operational and competitively positioned.

Confidently Strategize for the Future

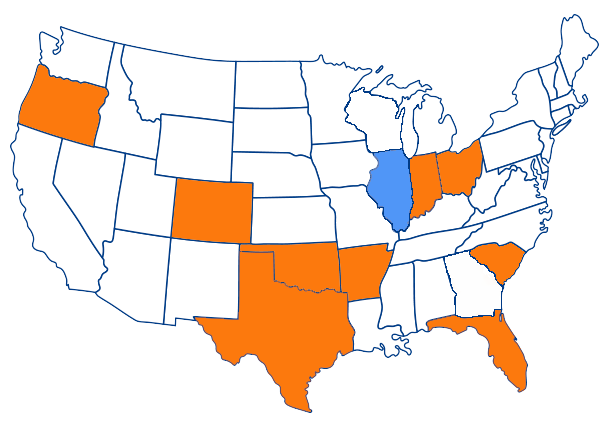

At Assurance Total Protection, we specialize in comprehensive general liability insurance tailored to meet your business’s specific needs.

Our expert team understands the unique challenges faced by businesses across various industries, ensuring you receive optimal general liability coverage options at competitive rates. We work closely with you to identify potential risks and provide solutions that fit your budget and requirements.

With our in-depth knowledge and commitment to exceptional service, you can confidently protect your business’s future and focus on growth. Contact us today for a personalized quote and experience peace of mind with our reliable insurance solutions.

FAQs

What does a general liability insurance policy cover?

A general liability insurance policy provides broad general liability insurance coverage, including protection against claims for bodily injury, property damage, and personal injury. It is essential for small business owners to ensure their business liability insurance is comprehensive.

How does general liability insurance protect a business?

General liability insurance protects a business by covering costs associated with legal claims and damages related to accidents, injuries, or property damage caused by the business’s operations. It is crucial for managing business risk and avoiding significant financial loss.

What is the difference between general liability insurance and professional liability insurance?

General liability insurance covers risks related to bodily injury, property damage, and personal injury, while professional liability insurance provides professional liability coverage for claims related to errors or omissions in the services provided. Both types of insurance are important for comprehensive business insurance.

How is the cost of general liability insurance determined?

The general liability insurance cost is determined based on factors such as the business size, industry risk, and coverage limits. Insurance coverage may also vary depending on whether additional policies, such as commercial auto insurance, are included in the business insurance package.