Freight Broker’s Insurance

Freight brokers are exposed to big risks every year, some end up in lawsuits or bankruptcy due to big judgments.

These can be mitigated with the right freight broker insurance. Large shippers require freight brokers to carry big insurance to protect their valuable freight. Without it, new brokers will miss out on big contracts because of lack of insurance certifications.

At Motive Insurance, we are your local experts, specialized in freight broker insurance. We partner with the top commercial insurer, Progressive, to give you customized insurance plans that fit your needs.

Understanding Freight Broker Insurance

Freight broker insurance includes various coverages to protect brokers from claims and financial loss. Key parts are general liability, contingent cargo and errors and omissions (E&O) insurance.

General liability covers third party bodily injury and property damage, contingent cargo covers losses when the carrier’s insurance fails. E&O insurance covers brokers against claims of negligence or mistakes in their services. Together these coverages give you complete protection so you can operate with confidence and get big contra

Essential Freight Broker Insurance Options

- BMC-84 Surety Bond

This bond guarantees the surety will pay if the broker fails to comply or doesn’t pay for services as agreed. It’s a must have for credibility and operational integrity. - BMC-85 Trust

This requires you to put $75,000 in trust which must be maintained as long as you have a valid broker license. FMCSA can use these funds for claims against your company, another layer of protection. - Contingent Insurance for Freight Brokers

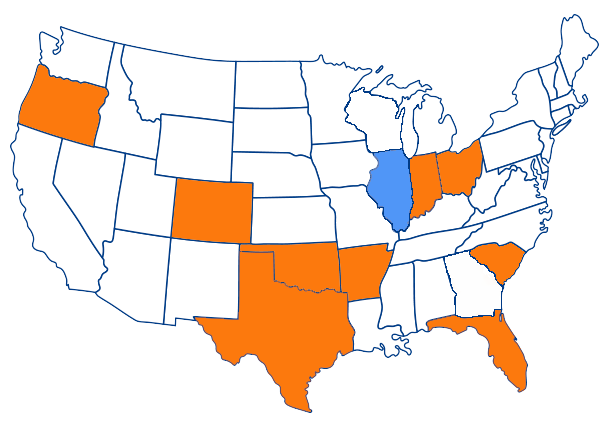

This insurance covers liability for cargo damage or loss, debris removal and environmental spills caused by accidents. Coverage is limited to the areas and states listed in the policy and only applies while cargo is in transit. - Contingent Auto Liability Insurance

When a motor carrier is hired, legal liability can arise from accidents or incidents involving that carrier. This policy protects the freight broker from such liabilities, very important coverage for any broker.

Does Every Freight Broker Need Insurance?

While it’s not mandatory to have insurance as a freight broker, it’s highly recommended. FMCSA requires proof of financial responsibility and having enough coverage will meet that requirement and give you and your shippers peace of mind.

Most shippers will require brokers to have certain types and amounts of insurance before they will work with you. Without these coverages you’ll miss out on big contracts and reve

Benefits of Partnering with Motive Insurance

At Motive Insurance we understand the unique risks freight brokers face in their daily operations. That’s why we offer industry specific insurance solutions. Our partnership with Progressive allows us to give you complete coverage at competitive rates so you can have peace of mind and get big contracts with shippers.

Some of the benefits of working with us:

- Expertise and Experience: Our team has extensive knowledge and experience in the freight broker industry. We can give you personalized advice on the right insurance for your business.

- Complete Coverage: We offer various coverages from general liability to E&O and contingent cargo insurance. So you have all the coverage you need for claims and losses.

- Competitive Rates: Through our partnership with Progressive we can give you very competitive rates for freight broker insurance. So you can get the coverage you need at an

Why Choose Motive Insurance?

Motive Insurance, with Progressive, offers premium insurance coverage for freight brokers and truckers. We have:

- Coverage for both freight brokers and truckers

- Protection against loss or damage to clients’ cargo from theft, collisions and fire

- Customizable policy limits and deductibles

- Agency discounts

Contact Motive Insurance today to get the best coverage for your freight brokerage. Protect yourself against theft, collisions, fire and other unexpected events with our in-depth insurance policies.

FAQs

What kind of insurance do I need for my freight broker business?

A freight broker business needs freight broker insurance which may include commercial auto insurance and coverage for freight broker operations to protect against liabilities.

How is freight broker insurance different from freight forwarder insurance?

Freight broker insurance covers the risks associated with broker activities while freight forwarder insurance covers managing and arranging shipments.

Do truck brokers need insurance for their operations?

Yes, truck brokers need insurance for their freight broker operations. This includes liability coverage for the motor carriers they work with.

How do domestic forwarders handle insurance?

Domestic forwarders need insurance that covers the transportation and logistics services they offer. This may include coverage for the freight and liability protection for the goods being shipped.