Commercial Van Insurance

In the world of American business 31.7 million small businesses rely on commercial vans to run their daily operations. These vehicles are the lifeblood of businesses like bakeries, florists, tech support services and medical suppliers.

Modern commercial vans are designed to maximize space with large cargo bays and flexible storage and fuel efficiency for these businesses.

Tailored Insurance Plans by Motive Insurance

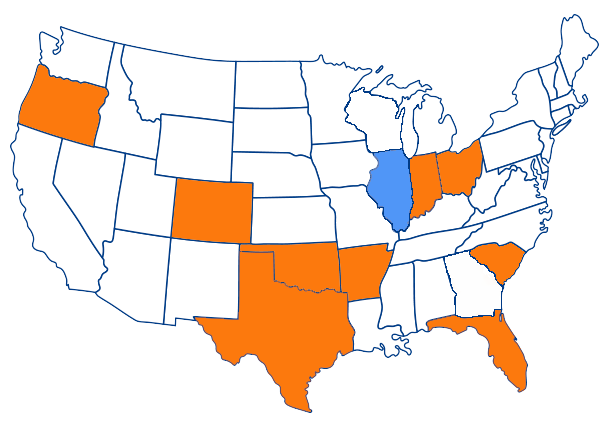

Motive Insurance, a local agency proudly affiliated with Geico Insurance, offers customized commercial van insurance plans for America’s small businesses.

Our insurance solutions are designed for small business owners and their employees whether you’re driving a company van or managing a fleet of your own. Liability insurance is a must have so we make sure your business is protected from financial loss.

In the event of an accident where you’re at fault our coverage takes care of injuries or damages to third party property. This foundation of protection is key to the stability and continuity of your business. By putting your insurance in our hands you can focus on what really matters; growing and thriving in your business knowing you have a safety net.

Comprehensive Coverage Options:

- Liability: This is the foundation of any commercial van insurance plan, covers damages and injuries you might cause to others if you’re at fault in an accident. It’s a requirement in most states and covers medical expenses, death benefits and property damage.

- Collision: Covers damages to your van regardless of who’s at fault, so your vehicle can be repaired or replaced as needed. And if the other party is at fault and uninsured we can still cover your damages through an uninsured motorist clause.

- Comprehensive: For non-collision incidents like theft, vandalism or environmental damage comprehensive insurance provides the necessary protection.

- Medical: Covers medical expenses for you and any passengers in the event of an accident and can include costs associated with fatal accidents.

- Uninsured/Underinsured Motorist: Protects you from losses caused by drivers who don’t have enough insurance coverage, which is key to mitigating unexpected costs.

Who Needs Commercial Van Insurance?

Determining if you need commercial van insurance is simple but requires some thought as to how you use your vehicle. If you use your vehicle for work purposes beyond just commuting such as transporting goods, people or services you’ll likely need a commercial policy.

This applies if you carry tools or equipment or if employees drive the vehicle. And if your business has high liability risks getting a commercial insurance policy is key to having full coverage.

Thinking through the specific uses of your vehicle in your business is key to making an informed decision on the right coverage to protect you from unexpected liabilities and expenses. Having the right commercial insurance not only protects your business but gives you peace of mind as you work.

The Role of Commercial Vans in Small Businesses

Commercial vans are more than just vehicles they’re the lifeblood of small businesses across America. These vans deliver goods and services.

Small businesses according to the Small Business Administration make up 99.9% of all businesses in the US. Between 2000 and 2019 they created 10.5 million net new jobs, twice as many as large corporations.

This highlights the importance of commercial vans in driving growth and stability for these businesses. Reliable transport is key to business success and small businesses need to thrive in competitive markets.

From delivering products to providing mobile services commercial vans are the essential tool that allows small businesses to meet customer demands quickly and contribute to the economy. Their importance to the economy cannot be overstated.

Why Choose Motive Insurance?

Choosing Motive Insurance means working with a commercial auto insurance leader. As part of the Progressive Commercial network we’re connected to the #1 commercial auto insurer in the US.

Our clients get competitive pricing options that can include discounts for bundling commercial auto with personal and other business insurance policies.

We understand the challenges small businesses face and are committed to providing the coverage that not only meets legal requirements but also fosters growth and stability. Contact Motive Insurance today and let us help you secure your business’s mobility and success.

FAQs

What is the difference between personal auto insurance and commercial auto insurance?

Personal auto insurance covers individual vehicles used for personal purposes, while commercial auto insurance covers vehicles used for business activities. A commercial vehicle insurance policy provides liability coverage and other protections specifically for commercial vehicles.

What does a commercial auto insurance policy cover?

A commercial auto insurance policy typically covers liability coverage, medical payments coverage, and damage to the vehicle. Business auto insurance is designed to protect commercial vehicles and often includes higher limits than personal auto insurance.

How much does commercial auto insurance cost?

Commercial auto insurance cost varies based on factors like the type of vehicle, how it’s used, and the desired coverage. Commercial auto insurance rates tend to be higher than personal auto insurance due to the increased risks associated with business use.

Does commercial auto insurance cover medical payments?

Yes, many commercial auto insurance policies include medical payments coverage. This coverage helps pay for medical expenses resulting from an accident involving a commercial vehicle, as part of the overall commercial auto coverage.