Commercial Truck Insurance

You want to keep your trucks on the road and running, not sitting idle and racking up unexpected bills.

At Motive Insurance we know the trucking industry and offer a range of insurance options to suit your trucking business. Our team will work with you to give you the right advice and support to protect your vehicles, drivers and cargo.

What Is Commercial Truck Insurance?

Commercial truck insurance, also known as commercial vehicle insurance or fleet insurance, is insurance for businesses that own and operate trucks for commercial purposes.

This is essential for companies that rely on transportation to deliver services or goods as cargo insurance protects against financial loss due to accidents, theft or damage. Coverage can be for a variety of vehicles including semi-trucks, box trucks, dump trucks, tow trucks and other large vehicles used to haul g

And commercial truck insurance also includes liability coverage which protects you if you are held liable for injuries or damages caused by your vehicles. It also covers medical expenses and property damage so you can have peace of mind knowing you are protecting your assets and operations.

Why Do You Need Commercial Truck Insurance?

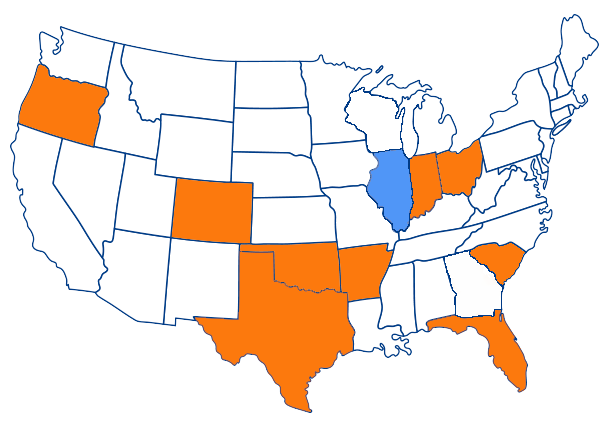

Proper coverage is key; without it you can face financial losses due to property damage, bodily injury claims or legal fees. Many states also require commercial truck owners to carry specific types of insurance to comply with regulations.

Insurance not only protects your business from unexpected costs but also compliance with state laws, your reputation and financial stability in the competitive trucking industry. Don’t ignore this critical coverage.

For example, standard commercial truck insurance may not cover natural disasters like floods or earthquakes. Some policies may also have exclusions for certain types of cargo or goods being hauled.

To make sure you have the right coverage for your business, work with an experienced and knowledgeable insurance provider who can help you through the complexities of commercial truck insurance and find the right coverage for you.

Does Commercial Truck Insurance Cover Everything?

While commercial truck insurance offers a wide range of coverage options, it’s essential to understand that not all types of accidents or damages may be covered.

For example, standard commercial truck insurance may not cover natural disasters such as floods or earthquakes. Additionally, some policies may have specific exclusions for certain types of cargo or goods being transported.

To ensure you have the right coverage for your unique business needs, it’s crucial to work with an experienced and knowledgeable insurance provider who can help you navigate the complexities of commercial truck insurance and find the best protection for your business.

Types of Coverage Offered

Commercial truck insurance includes several types of coverage to protect different areas of risk. Here are some o

- Liability: As mentioned above liability insurance covers costs for injuries or damages caused by your commercial trucks.

- Physical damage: This type of insurance covers accidental damage to your vehicles, collisions, vandalism or theft.

- Cargo: Cargo insurance covers damage and loss to cargo being hauled by your commercial trucks. It also covers spoilage or contamination of perishable goods.

- Uninsured/underinsured motorist: In the event of an accident with a driver who doesn’t have enough insurance coverage this type of insurance will cover costs for damages and medical expenses.

- Non-trucking liability: This coverage protects your drivers when they are using their vehicles for non-business

Expert Coverage for Your Trucking Business

At Motive Insurance we are trucking industry experts. Our knowledge of the industry allows us to offer coverage solutions that will protect your assets. We offer competitive pricing and customized coverage options so your business is fully covered.

Check out our commercial truck insurance options and let us help you protect your fleet on the road. Contact us today.

FAQs

What is covered in a commercial truck insurance policy?

A commercial truck insurance policy covers commercial trucking insurance, liability, cargo insurance and physical damage to the truck. It covers trucking companies and motor carrier.

How is commercial trucking insurance different from commercial auto insurance?

Commercial trucking insurance is designed for trucking companies and motor carriers, it covers things specific to freight transportation. Commercial auto insurance covers all types of co

What is cargo insurance and how does it help trucking companies?

Cargo insurance covers the goods being hauled by covering losses due to damage, theft or other risks. It’s part of trucking insurance for trucking companies to ensure the cargo is covered while in transit.

Why do trucking companies need a commercial auto policy?

A trucking company needs a commercial auto policy to get insurance coverages specific to their operations, liability, cargo and physical damage. This policy will protect the company from all risks of trucking operation.