Auto insurance in America

In the USA, cars are almost a national pastime, deeply embedded in the culture and lifestyle of its people. As of 2020, the US population was 329.5 million and 276 million vehicles registered.

With that many vehicles on the road, it’s no wonder accidents happen – 6 million a year to be exact. That’s why you gotta be prepared.

With these numbers, having auto insurance isn’t just a good idea; it’s a must. It’s the best way to make sure a road mishap doesn’t become a financial nightmare.

Auto insurance helps individuals recover fast from accidents, and gives them financial security during stressful times. In a country where the open road means freedom and opportunity, having peace of mind with comprehensive coverage is smart and necessary. This protection not only protects personal assets but also the community as a whole.

Cost of auto insurance

Auto insurance costs vary and are dependent on many factors – your driving habits, the type of vehicle you drive, where you drive your vehicle and your driving history.

Knowing these variables is key to finding the right insurance plan. At Motive Insurance, we create customized insurance plans that offer comprehensive coverage and great value.

Our way ensures each plan is tailored to your needs, so you can have peace of mind on the road.

What Motive Insurance offers

At Motive Insurance, we are auto insurance experts, so your coverage meets your needs and our high standards. We know having the right coverage is key to your peace of mind and that’s why we offer a range of standard coverages to protect you in various situations:

- Liability Insurance: This essential coverage protects you if you cause damages to others in an accident, covering property damage and bodily injury to other parties.

- Collision Insurance: If your vehicle gets damaged in a collision, this coverage helps pay for the repairs so your car can get back on the road as soon as possible.

- Comprehensive Insurance: Life is unpredictable and your vehicle can get damaged from non-collision events like weather incidents, theft or vandalism. Comprehensive insurance covers these unexpected events and gives you extra protection.

- Medical Payments/Personal Injury Protection: In the event of an accident, this vital coverage pays for medical expenses for you and your passengers. It may also cover other financial losses like lost income, a safety net during recovery.

- Uninsured/Underinsured Motorist Insurance: Not all drivers are insured. This coverage protects you from damages caused by drivers without enough insurance, so you’re not left exposed.

With Motive Insurance, you can drive with peace of mind knowing your insurance is designed to cover what you need, when you need it. Your safety and satisfaction is our top priority.

Beyond these, we also provide additional customizable options to enhance your protection:

Besides that, we also offer additional customizable options to give you more protection:

- Roadside Assistance: This service helps you in emergencies such as towing or tire changes so you get assistance when you need it most, wherever you are stranded.

- Rental Car Reimbursement: This feature covers the cost of a rental car so you can continue with your daily activities without interruption while your own vehicle is being repaired.

- Custom Parts Coverage: Insure aftermarket parts of your car and this coverage ensures the unique features and enhancements you added to your vehicle are protected, preserving their value and functionality.

- Replacement Cost Vehicle Coverage: If your car is totaled, this coverage pays for a brand new car of the same make and model so you can replace your vehicle without financial burden and continue driving the car you love.

- Vanishing Deductibles: As a reward for your safe driving habits, this feature reduces your deductible amount over time so you get financial relief and recognition of your commitment to road safety.

- Gap Insurance: This important coverage covers the difference between what your vehicle is worth and what you owe on it so you won’t be left paying out of pocket if your vehicle is worth less than the loan balance.

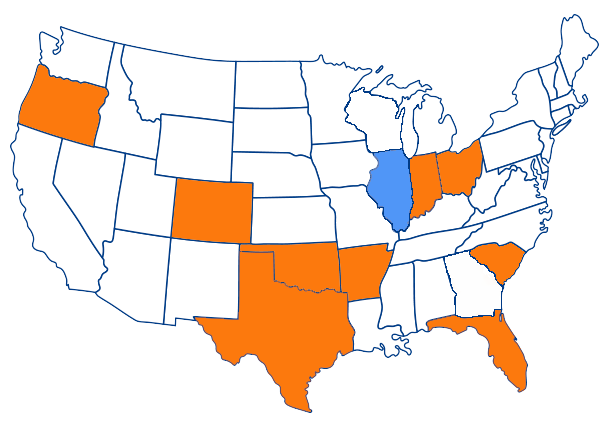

Every state has its own minimum requirements and our team at Motive Insurance will help you choose the right coverage and options. We’re here to help you pick the best for you. Be prepared for the unexpected and get fully covered for every turn of the road ahead, so your journey is as smooth as possible.

FAQs

What factors affect car insurance costs in America?

Car insurance costs in America are influenced by factors like driving history, location, vehicle type, and even poor credit. Insurance companies also consider the amount of auto insurance coverage, such as liability coverage and collision coverage, when determining car insurance rates.

How can I lower my car insurance cost?

To lower your car insurance cost, you can shop around for car insurance discounts, improve your credit score, or bundle policies. Many car insurance companies offer discounts for safe driving or multiple policies, which can help reduce your car insurance policy cost.

What is the average annual cost of car insurance in America?

The average annual cost of car insurance in America depends on various factors such as state, age, and coverage type. Auto insurers calculate car insurance rates based on these factors, with the national average varying by location and insurance company.

What is the best car insurance company for personal auto insurance?

The best car insurance company for personal auto insurance depends on individual needs and preferences. It’s important to compare car insurance companies based on car insurance rates, coverage options like collision coverage and liability coverage, and customer service.